If you’ve been involved in the investing world for some time, you’ve probably heard the classic saying, “Don’t put all your eggs in one basket.” On the other hand, you might have heard someone advocate for the exact opposite, using the same analogy: “Put all your eggs in one basket and watch it closely.”

Two Camps of Thought on Risk

Intelligent investors often seek to minimize risk, but there are two opposing schools of thought regarding diversification.

- The Diversification Advocates:

This group believes that buying shares in many companies reduces portfolio risk. If one company experiences a catastrophe, you’ll still have others to rely on. - The Anti-Diversification Advocates:

This camp argues that owning too many companies often means you don’t understand any of them well enough, which in itself is risky.

Today, I want to point out that both groups miss an essential point, and in a sense, they’re both wrong.

Your Income as an Asset

Let’s start with a thought experiment. Suppose you live in the U.S., are around 30 years old, and earn $50,000 per year. Based on data from the Bureau of Labor Statistics, if you work until age 70 and account for an annual 3.5% wage increase, your total lifetime earnings will be approximately $5.2 million. After taxes, this comes to about $4.3 million in take-home pay.

Now, using a 10% discount rate to calculate the net present value (NPV) of your future salary, you get $710,000. That’s a significant number!

Contrast this with the median net worth of households aged 35 or younger, which, according to the Federal Reserve’s 2019 survey, is approximately $14,000. Clearly, your current savings and investments are just a small fraction of the NPV of your future salary.

Implications of Income on Diversification

These numbers reveal something important: for most young investors, diversification—or lack thereof—doesn’t significantly impact your risk profile. Why? Because your portfolio represents only a small portion of your total financial picture, which is dominated by your future earning potential.

Two Schools of Thought on Diversification:

- Diversification Advocates: They argue, “Diversification is the only free lunch in investing. Spread your investments out to reduce risk.”

- Anti-Diversification Advocates: They claim, “Diversification is for those who don’t know what they’re doing. Focus your investments where you have expertise.”

For young investors, however, no matter which group you follow, you’ll remain undiversified because the majority of your financial worth lies in your future salary.

Investing in Your 20s and 30s: A Learning Opportunity

For young investors, the primary focus of investing should not be diversification but learning. If you lose all your capital in your early 20s, it’s not the end of the world—you can replace it quickly with your salary.

Investing in something like the S&P 500 index at this stage may be a mistake. While it’s considered a safe, diversified option, it provides little experience with analyzing individual companies or industries. Instead, focus on gaining knowledge through hands-on investing.

When I started investing in 2013, I picked just three companies. My results were mediocre, but the experience taught me valuable lessons that have since helped me make better decisions. Learning from small losses early on can accelerate your growth as an investor.

Diversification and Risk Reduction: Think Beyond Your Portfolio

If your goal is to reduce financial risk, the real focus should be on securing and growing your income. This can include:

- Investing in education to boost your earning potential.

- Building additional income streams through side hustles or entrepreneurial ventures.

- Maintaining your health, which ensures you can work longer and more effectively.

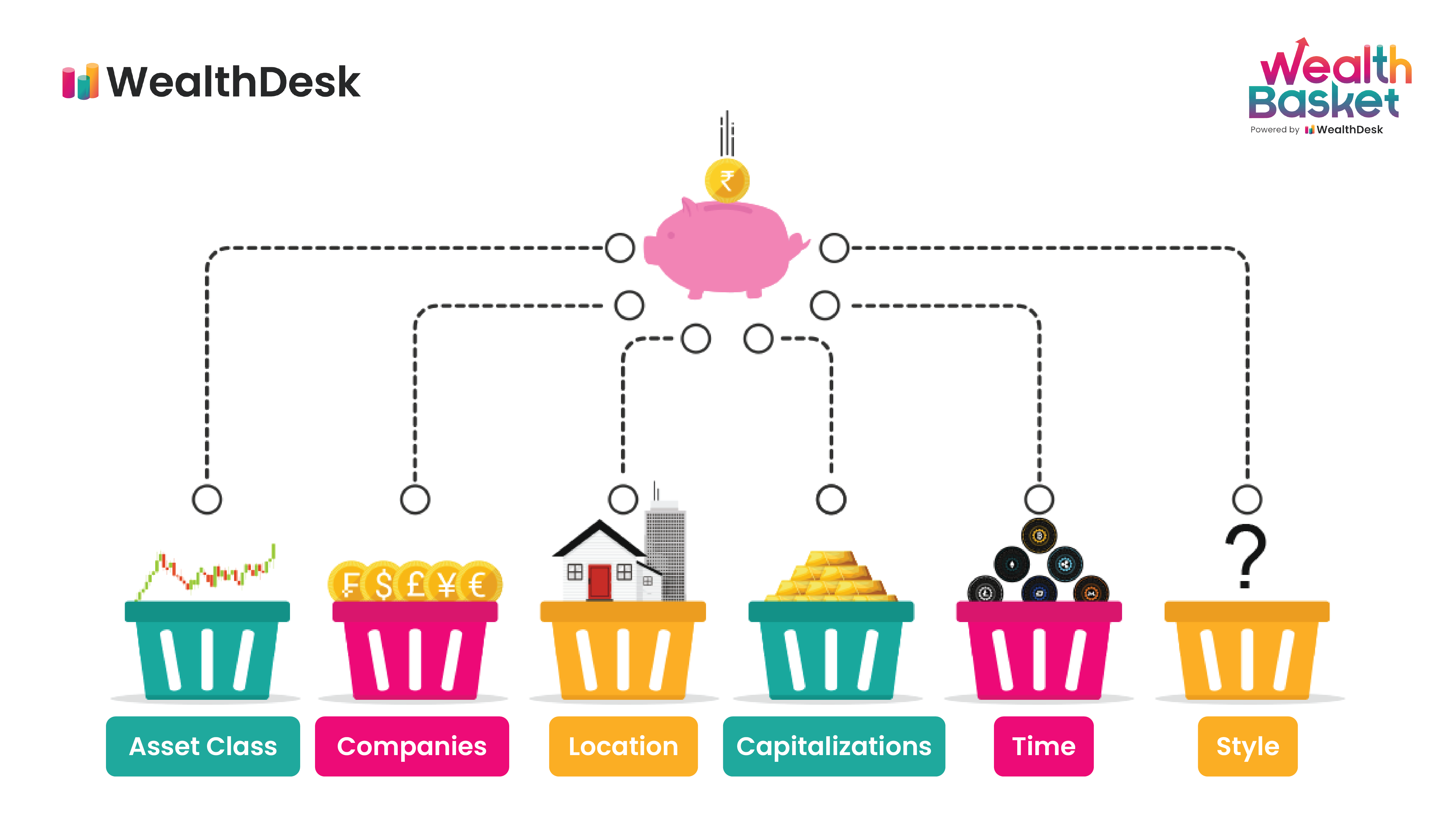

Diversification is a cornerstone of smart investing, designed to reduce risk while maximizing returns over time. By spreading investments across different asset classes, sectors, and geographies, investors can mitigate the impact of market volatility and capitalize on growth opportunities. This guide explores how to diversify your portfolio effectively for both stability and growth.

- What is Portfolio Diversification?

Diversification involves allocating your investments across various asset types and categories to minimize risk. The idea is that different investments will perform differently under the same economic conditions, reducing the likelihood of a significant loss in your portfolio.

Benefits of Diversification:

- Reduces exposure to market volatility.

- Provides opportunities for growth across different conditions.

- Key Components of a Diversified Portfolio

- Asset Classes

Diversifying across asset classes helps manage risk since different types of assets react differently to market conditions.

- Stocks: Offer higher growth potential but come with higher volatility.

- Diversify by sector (e.g., technology, healthcare).

- Include domestic and international stocks.

- Bonds: Provide stability and consistent income, especially during stock market downturns.

- Include a mix of government, corporate, and municipal bonds.

- Consider varying maturities for better balance.

- Real Estate: Adds a tangible asset to your portfolio and offers potential income through rentals or REITs (Real Estate Investment Trusts).

- Commodities: Hedge against inflation by investing in gold, silver, oil, or agricultural products.

- Cash and Cash Equivalents: Maintain liquidity for emergencies and opportunistic investments.

- Alternative Investments: Include private equity, hedge funds, or cryptocurrencies for additional diversification.

- Diversification Within Asset Classes

- Stocks

- By Sector: Invest across industries like technology, finance, healthcare, and energy to avoid overexposure to one sector.

- By Market Cap: Balance between large-cap, mid-cap, and small-cap stocks for varied growth potential.

- By Geography: Include international stocks to benefit from global growth trends and reduce reliance on a single economy.

- Bonds

- Credit Quality: Mix investment-grade and high-yield bonds.

- Duration: Include short-term, intermediate, and long-term bonds to manage interest rate risk.

- Real Estate

- Direct Ownership: Buy properties for rental income.

- Indirect Investment: Invest in REITs or real estate mutual funds for diversification without the need for property management.

- Strategies for Effective Portfolio Diversification

- Follow the 60/40 Rule

Traditionally, portfolios were split 60% in equities and 40% in bonds. While not rigid, this ratio provides a good starting point.

- Use ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds offer built-in diversification by investing in a basket of assets

- Regular Rebalancing

Example: If your target allocation is 70% stocks and 30% bonds, rebalance if stocks grow to 80% of your portfolio.

- Dollar-Cost Averaging (DCA)

Investing a fixed amount at regular intervals reduces the risk of market timing and smoothens the impact of market volatility.

- Seek Professional Advice

Financial advisors or robo-advisors can help design a diversified portfolio tailored to your needs.

- Common Mistakes in Diversification

- Over-Diversification

Spreading investments too thinly can dilute potential returns and make portfolio management difficult.

- Ignoring Correlation

Ensure that your investments don’t all move in the same direction during market shifts.

- Neglecting Rebalancing

Failing to adjust your portfolio regularly can lead to unintended risk exposure.

- Emotional Investing

Stick to your diversification plan.

- Diversification for Different Investor Types

- Conservative Investors

- Focus on stability with higher allocations to bonds, cash, and dividend-paying stocks.

- Include blue-chip stocks and government bonds.

- Moderate Investors

- Maintain a balanced mix of stocks and bonds.

- Add some exposure to alternative investments like REITs or commodities.

- Aggressive Investors

- Emphasize growth with higher allocations to equities, small-cap stocks, and international markets.