1. Understand the Risks of Options Trading

Before diving into strategies, it’s crucial to understand How to Manage Risk in Option Trading Like a Pro by recognizing the different types of risks involved. These include:

- Time Decay (Theta Risk): Options lose value over time, affecting long option positions.

- Liquidity Risk: Some options may have low trading volume, making it difficult to enter or exit positions efficiently.

- Implied Volatility Risk: Changes in volatility can impact option premiums, affecting profitability.

Being aware of these risks allows traders to take proactive steps to mitigate potential losses.

2. Position Sizing and Risk Allocation

One of the key aspects of How to Manage Risk in Option Trading Like a Pro is proper position sizing.

- Risking only 1-3% of total capital per trade to prevent large losses.

- Diversifying trades across different assets or strategies to minimize exposure to a single market event.

- Using stop-loss orders or mental stops to exit losing trades before losses escalate.

Proper risk allocation ensures that no single trade can wipe out a significant portion of your portfolio.

3. Use Stop-Loss Orders and Exit Strategies

Another crucial technique in How to Manage Risk in Option Trading Like a Pro is having a well-defined exit strategy. Traders should implement stop-loss orders to limit downside risk. Some effective approaches include:

- Percentage-Based Stop Loss: Exiting a trade if the option price declines by a set percentage.

- Time-Based Exits: Closing a position before expiration to avoid excessive time decay.

- Profit Target Exits: Taking profits at predefined levels to lock in gains before market conditions change.

Having a clear exit plan reduces emotional decision-making and prevents unnecessary losses.

4. Hedging Strategies to Minimize Losses

Hedging is an advanced technique that professional traders use to protect their portfolios. As part of How to Manage Risk in Option Trading Like a Pro, traders can employ various hedging strategies such as:

- Protective Puts: Buying put options to hedge long stock positions against market downturns.

- Covered Calls: Selling call options against owned stock to generate income and reduce downside risk.

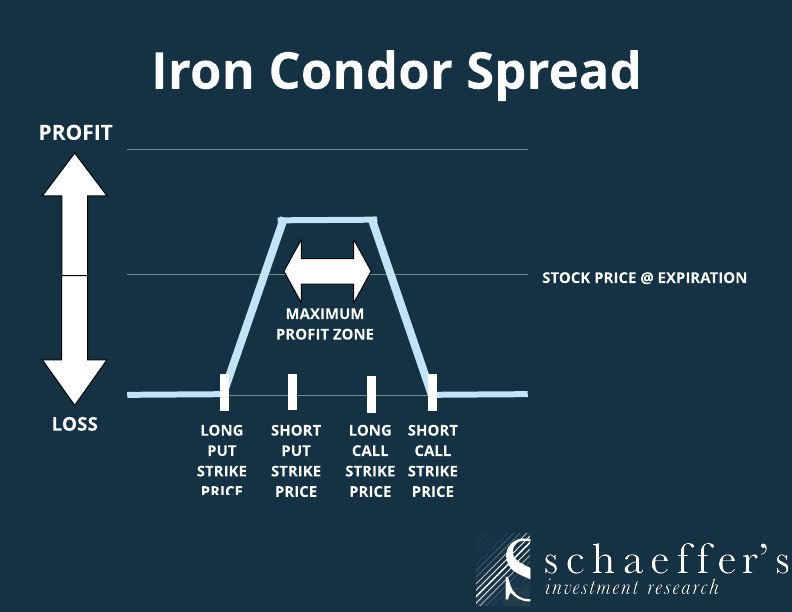

- Spreads (Vertical, Calendar, or Iron Condors): Combining multiple option positions to limit risk while maintaining profit potential.

Using hedging techniques can help traders minimize losses while still participating in market movements.

5. Managing Implied Volatility and Time Decay

Understanding How to Manage Risk in Option Trading Like a Pro requires knowledge of implied volatility and time decay. These factors significantly impact option prices:

- Low Implied Volatility: Buying options when volatility is low can result in higher profits if volatility rises.

- High Implied Volatility: Selling options during high volatility can generate income as volatility contracts.

- Theta Management: Selling options with short expiration periods benefits from time decay, while buying options requires careful timing to avoid value erosion.

By monitoring volatility and time decay, traders can improve their trade timing and risk management.

6. Keep a Trading Journal and Review Performance

The final step in How to Manage Risk in Option Trading Like a Pro is maintaining a trading journal. Keeping records of all trades, including entry/exit points, strategy used, and market conditions, helps traders:

- Identify patterns in their trading behavior.

- Learn from past mistakes and refine strategies.

- Track risk-reward ratios to ensure a sustainable trading approach.

Regularly reviewing performance allows traders to adjust their risk management techniques and improve long-term profitability.