Options traders seeking a balanced strategy that limits risk while generating steady income often turn to iron condors. Understanding how to use iron condors for low-risk profits can help traders capitalize on range-bound markets while keeping losses under control. This article explores the fundamentals of iron condors and how to use them effectively.

What Are Iron Condors?

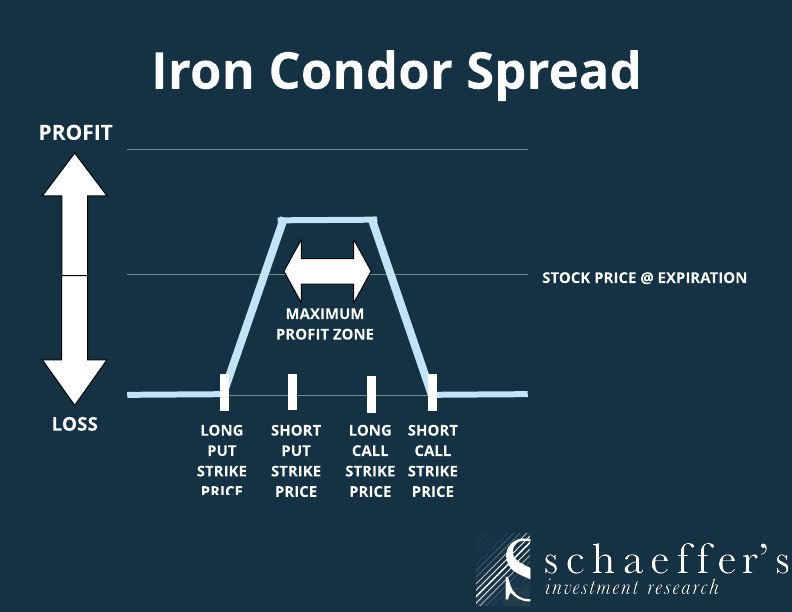

How to use iron condors for low-risk profits begins with understanding their structure. An iron condor is a neutral options trading strategy that involves selling a lower strike put, buying a higher strike put, selling a lower strike call, and buying a higher strike call—all with the same expiration date. This strategy profits when the stock price remains within a predefined range.

How to Use Iron Condors for Low-Risk Profits

To successfully execute how to use iron condors for low-risk profits, traders follow these steps:

- Select a Stock or Index: Choose an asset that is expected to trade within a stable range.

- Determine the Strike Prices: Set up the iron condor with an appropriate range to maximize premium income while limiting risk.

- Sell a Put and a Call Spread: Sell a lower strike put and a higher strike call while purchasing protective options at further strike prices.

- Manage the Trade: Monitor market movements and adjust the position if necessary to minimize risk and lock in profits.

Advantages of Iron Condors

Understanding how to use iron condors for low-risk profits provides several benefits, including:

- Limited Risk: The maximum loss is capped by the protective options purchased.

- Consistent Income: Traders collect premium income as long as the stock remains within the expected range.

- High Probability of Success: Since the trade profits in a stable market, it has a greater chance of winning compared to directional strategies.

These advantages make iron condors an attractive strategy for conservative traders seeking steady returns.

Best Market Conditions for Iron Condors

Traders who want to learn how to use iron condors for low-risk profits should identify the right market conditions, including:

- Low Volatility: Iron condors work best when price movements are minimal.

- Sideways Markets: Stocks trading within a range increase the probability of success.

- Stable Economic Conditions: Markets with reduced uncertainty favor iron condor strategies.

-

Maximizing Returns with Iron Condors: A Low-Risk Strategy

Options traders looking for a steady and controlled way to generate income often rely on iron condors. Mastering how to use iron condors for low-risk profits allows traders to benefit from range-bound markets while keeping their potential losses in check. This article explores the mechanics of iron condors and how traders can leverage them effectively.

Understanding Iron Condors

How to use iron condors for low-risk profits starts with grasping their structure. An iron condor is a neutral options strategy that involves four options contracts: selling a lower strike put, buying a higher strike put, selling a lower strike call, and buying a higher strike call—all set with the same expiration date. The strategy profits when the stock price remains within a specified range.

Steps to Implement Iron Condors

To successfully execute how to use iron condors for low-risk profits, traders follow these key steps:

- Select a Stock or Index: Choose an asset expected to remain within a predictable range.

- Establish Strike Prices: Set up an iron condor with strike prices that balance premium income and risk.

- Sell Put and Call Spreads: Sell a lower strike put and a higher strike call while purchasing protective options further away from the current price.

- Monitor and Adjust: Track price movements and adjust the position if necessary to manage risk and optimize gains.

Benefits of Iron Condors

Understanding how to use iron condors for low-risk profits comes with several advantages, including:

- Defined Risk Exposure: Losses are capped by the protective options bought.

- Reliable Income Stream: Collecting premium income provides consistent returns in neutral markets.

- High Success Rate: This strategy is more likely to succeed in stable conditions than directional trades.

These benefits make iron condors particularly appealing to traders seeking controlled yet steady profits.

Ideal Market Conditions for Iron Condors

Traders aiming to master how to use iron condors for low-risk profits should identify optimal market conditions, such as:

- Low Volatility: Iron condors are most effective when price swings are minimal.

- Range-Bound Stocks: Stocks that trade within a defined range enhance profitability.

- Predictable Market Trends: A stable economic environment supports successful execution.