Welcome to Mastering Implied Volatility: What Every Options Trader Needs to Know

Dare I say, this is one of the most important and best options trading videos I have created? This video is packed with simple explanations and extensive data visualizations to help you fully understand implied volatility. More importantly, you will learn what you want implied volatility to do when trading the most popular options strategies.

I promise you, this video is going to be a game-changer, especially if you are new to options trading. So, let’s get started!

What is Implied Volatility?

To understand implied volatility, it helps to break down the term into simpler words. Instead of “implied,” think of “hinted” or “suggested,” and instead of “volatility,” think of “price movements” or “price fluctuations.”

Essentially, implied volatility refers to the expected magnitude of a stock’s price changes in the future, as implied by its options prices. When looking at option prices on a particular stock, these prices suggest anticipated future behavior of the stock price.

For example, consider SPY (the S&P 500 ETF) with a current price of $447. A 40-day, $450 strike call option on SPY is priced at $8. In contrast, NVIDIA, which had the same closing stock price, has a $450 strike call option trading for $34.50. The implied volatility of SPY is 17%, whereas for NVIDIA, it is 60%. This means NVIDIA’s higher option prices indicate that its stock price is much more volatile compared to SPY.

Implied Volatility vs. Realized Stock Volatility

To illustrate this concept, I analyzed five years of historical data and created a histogram of daily percentage changes in SPY and NVIDIA. The results showed that SPY’s daily price changes are more stable and less extreme compared to NVIDIA, whose stock exhibits higher volatility.

This difference in realized volatility directly impacts the pricing of options. Since NVIDIA’s stock fluctuates more than SPY’s, the option prices for NVIDIA are significantly higher, leading to higher implied volatility.

How Implied Volatility Affects Options Strategy Performance

Implied volatility plays a crucial role in options trading because changes in expected stock volatility affect option prices, which in turn influence trade profitability.

To explore this, let’s analyze how popular options strategies perform when implied volatility changes. In the following examples, we assume an entry implied volatility of 20%, then simulate a 10% decrease (to 10%) and a 10% increase (to 30%). The days to expiration are held constant at 60 days.

Buying Call Options

When buying a call option, we want implied volatility to increase. If implied volatility rises after purchasing a call, the profitability improves. Conversely, a decline in implied volatility results in lower option prices, reducing potential gains.

Buying Put Options

Similarly, when buying a put option, we also want implied volatility to rise. An increase in implied benefits put buyers, whereas a decrease leads to reduced option values.

Selling Strangles

A short strangle is a neutral strategy involving selling an out-of-the-money put and call. Here, traders want implied volatility to fall. A decrease in implied volatility leads to shrinking option prices, boosting profitability. However, an increase in implied volatility negatively affects the trade.

Selling Straddles

Short straddles involve selling both a call and put at the same strike price. Like strangles, short straddle traders also benefit from falling implied volatility. Lower volatility means a higher probability that the stock will stay near the strike price, reducing option premiums and increasing profitability.

Understanding Implied Volatility Changes and Trade Performance

A decrease in implied indicates lower uncertainty about future price movements, increasing the probability of the stock remaining near its current price. This causes option prices to shrink.

For example, in a short straddle, a drop in implied volatility signals that the market expects less volatility in the future. Since the straddle seller benefits from declining option prices, lower implied volatility leads to greater profitability.

Conversely, an increase in implied volatility means there is more uncertainty about future stock movements. This expands option prices, making it more expensive to hold options.

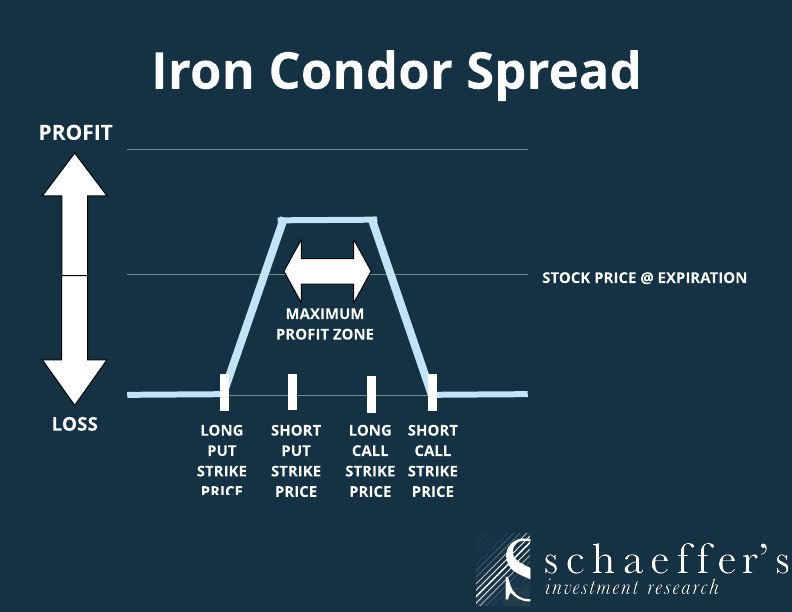

For instance, if you short an iron condor and implied volatility rises, the probability of the stock price staying between the short strikes decreases. This makes the iron condor position less profitable.

Implied Volatility Behavior on Meme Stocks

A fascinating case study of implied can be seen in meme stocks such as GameStop (GME).

Imagine a trader shorting GME’s price surge in early 2023 by purchasing slightly out-of-the-money put options at the peak of the rally. Even though the stock price fell toward and through the put strike price, the put option still lost value. This is a prime example of how implied can overwhelm a trade, even if the direction is correct.

The reason? Implied collapsed. Despite the falling stock price, GME’s implied dropped from 100% to about 55%, reducing option premiums and leading to losses for put buyers.

Meme stocks exhibit a unique behavior where implied tends to rise with the stock price. For example, when GME’s stock surged from $18 to $27, its implied jumped from 60% to over 100%.

For traders who bought call options on these stocks, the combined effect of rising stock prices and surging implied led to explosive gains. For instance, a call option priced at just over $10 could increase nearly sixfold to $60, purely due to the dual impact of stock movement and implied expansion.

Final Thoughts

Understanding implied is essential for every options trader. Whether you are buying calls and puts, selling strangles and straddles, or trading complex spreads, knowing how implied affects your trades can make all the difference in your profitability.

If you want a more in-depth guide, you can download my free 170+ page options trading PDF, packed with explanations and visualizations to help you master the fundamentals. Check the link in the description to grab your copy.

If you found this information valuable, leave a comment below and share it with your fellow traders. My name is Chris from Project Finance, and I’ll see you in the next video!

What is Implied Volatility?

Implied volatility (IV) is a crucial factor in options trading that reflects the market’s expectations of future price movements. Unlike historical volatility, which looks at past price fluctuations, IV represents the anticipated level of volatility in the stock or asset over the life of the option.

Traders use implied volatility to gauge market sentiment. When IV is high, it means the market expects larger price swings. Conversely, when IV is low, it suggests that smaller movements are expected. Understanding how IV works can help traders make informed decisions when entering and exiting trades.

How Implied Volatility Affects Option Prices

One of the most important aspects of implied volatility is its direct impact on option premiums. The higher the IV, the more expensive options become, and the lower the IV, the cheaper they get. This happens because options pricing models, like the Black-Scholes model, consider IV a critical input when calculating an option’s fair value.

For example, during market uncertainty—such as earnings announcements or major economic events—IV tends to rise, increasing the price of options. On the other hand, when markets are stable and predictable, IV declines, making options more affordable.

Traders need to monitor IV levels before buying or selling options to ensure they are not overpaying for contracts.

High vs. Low Implied Volatility: What It Means for Traders

Understanding whether implied volatility is high or low can help traders develop effective strategies:

-

High IV: When IV is elevated, option premiums are expensive. This benefits option sellers, as they can collect higher premiums. However, option buyers face the risk of overpaying for contracts that may decrease in value if IV drops.

-

Low IV: When IV is low, option premiums are cheaper. This creates opportunities for option buyers, as contracts are more affordable. However, low IV environments often indicate smaller price movements, which can limit profit potential.

A useful tool for assessing IV levels is the Implied Rank (IVR), which compares current IV to historical IV levels. If IVR is high, the market expects greater uncertainty; if it’s low, it suggests calmer conditions.

The Role of Implied Volatility in Options Strategies

IV plays a crucial role in determining which options strategies work best in different market conditions:

-

High IV Strategies: Traders looking to take advantage of high implied often use strategies such as iron condors, credit spreads, and straddles. These strategies involve selling options to benefit from a decrease in IV.

-

Low IV Strategies: When IV is low, traders typically use strategies like long calls, long puts, or debit spreads, which benefit from an increase in IV. If IV expands, option prices rise, increasing potential profits.

Selecting the right strategy based on IV levels can significantly improve risk management and profitability.

How Implied Volatility Impacts Risk Management

Managing risk is essential in trading, and understanding IV can help traders minimize potential losses.

-

IV Crush: A sudden drop in IV, known as IV crush, can significantly reduce option premiums. This often occurs after major events like earnings announcements. If a trader buys an option before an earnings report and IV drops after the announcement, the option’s value may decline even if the stock moves in the expected direction.

-

Avoiding Overpaying: Many traders make the mistake of purchasing options when IV is at extreme highs, leading to poor risk-reward ratios. By analyzing IV before placing a trade, traders can determine whether options are fairly priced.

-

Position Sizing: Since high IV environments lead to more expensive options, traders should adjust position sizes to manage risk effectively. This means buying fewer contracts when IV is high and increasing position sizes when IV is low.

Final Thoughts: Mastering Implied Volatility for Better Trades

Implied volatility is a powerful tool that can influence options pricing, strategy selection, and risk management. Traders who understand how IV works can capitalize on market conditions by choosing the right options strategies at the right time.

By monitoring IV levels, avoiding overpriced contracts, and using IV-driven strategies, traders can enhance their profitability and minimize risk exposure. Whether you’re an options buyer or seller, mastering implied volatility will give you a significant edge in the market